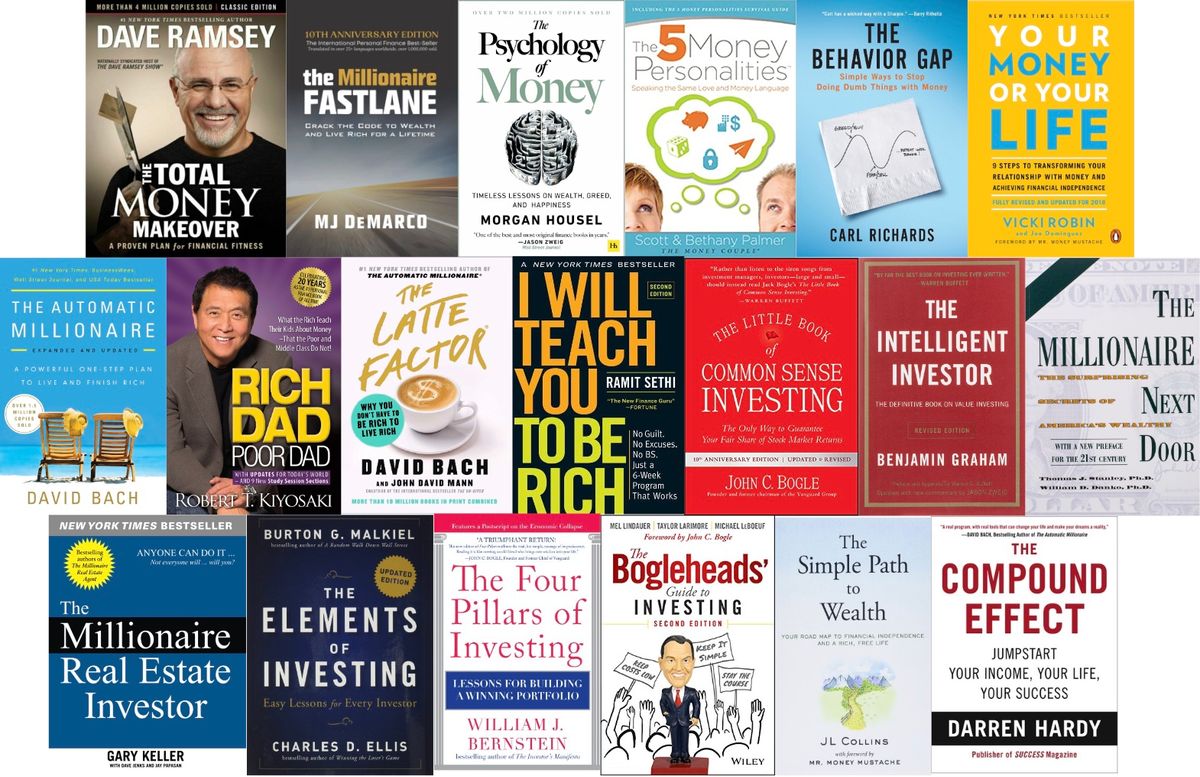

Personal finance books

Over the coming weeks I will be learning and teaching my kids about personal finance. I have learnt quite a bit about that during the past few years but instead of jumping in straight away and teach them what I know, I have decide to first look at the best selling books in that domain. I am pretty sure this will help me structure my thinking and there are very likely good ideas that I'm not aware of yet.

I looked up the best selling books on Amazon and then asked ChatGPT to provide a short summary of the book. You will find the list below, you may want to add some of these to your reading list.

Over the coming weeks I'll be putting together summaries of these books and then I'll distill that and provide my own opinions.

General personal finance

The Total Money Makeover: A Proven Plan for Financial Fitness

"The Total Money Makeover: A Proven Plan for Financial Fitness" is a personal finance book written by Dave Ramsey that provides a step-by-step plan for paying off debt, saving money, and building wealth. The book advocates for a debt-free lifestyle and encourages readers to follow a seven-step plan to financial freedom, which includes saving a cash emergency fund, paying off debts using the "debt snowball" method, and investing in retirement and other long-term goals. The book also provides practical tips for budgeting, saving money, and making smart financial decisions.

Read the book summary here.

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

"The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime." is a personal finance book written by M.J. DeMarco that provides a unconventional approach to building wealth. The book argues that the traditional paths to wealth, such as saving and investing, are slow and unreliable, and instead advocates for building wealth through entrepreneurship and building businesses. The book provides practical advice for starting and growing a business, including tips for identifying and pursuing business opportunities, developing a business plan, and marketing one's products or services. The book also encourages readers to think outside the box and to take calculated risks in order to achieve financial success.

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

"The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness" is a personal finance book written by Morgan Housel that explores the psychological and emotional factors that influence how people think about and manage money. The book covers a range of topics related to personal finance, including saving, investing, and spending, and argues that understanding and managing one's psychological biases is key to achieving financial success. The book provides practical advice for avoiding common financial pitfalls and for building wealth, and includes a range of anecdotes and examples to illustrate the concepts discussed. The book is written in a engaging and accessible style and is intended for readers of all levels of financial literacy.

The 5 Money Personalities: Speaking the Same Love and Money Language

"The 5 Money Personalities: Speaking the Same Love and Money Language" is a personal finance book written by Scott and Bethany Palmer that provides a unique approach to managing money in relationships. The book is based on the idea that people have different "money personalities" and that understanding and managing these differences is key to achieving financial harmony in a relationship. The book identifies five different money personalities and provides practical advice for couples on how to manage their finances and resolve financial conflicts based on their individual money personalities. The book also provides practical advice for setting and achieving financial goals as a couple and for building a strong financial foundation for a lasting relationship.

The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money

"The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money" is a personal finance book written by Carl Richards that focuses on the psychological barriers that prevent people from making smart financial decisions. The book argues that people often make irrational decisions with their money due to a variety of psychological biases and emotions, and that understanding and overcoming these biases is key to achieving financial success. The book provides practical advice for avoiding common financial pitfalls, including tips for managing risk, avoiding emotional investing, and setting and achieving financial goals. The book also includes a range of illustrations and examples to help readers understand and apply the concepts discussed in the book.

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018

"Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018" is a personal finance book written by Vicki Robin that provides a holistic approach to managing money and achieving financial independence. The book advocates for aligning one's financial goals with their personal values and emphasizes the importance of reducing expenses and increasing income in order to achieve financial independence. The book also encourages readers to track their net worth and to invest in assets that generate passive income. The book provides a nine-step program for achieving financial independence, which includes tracking expenses, creating a financial plan, and investing in one's education and career.

The Millionaire Next Door: The Surprising Secrets of America's Wealthy

"The Millionaire Next Door: The Surprising Secrets of America's Wealthy" is a personal finance book written by Thomas J. Stanley and William D. Danko that explores the habits and characteristics of millionaires in the United States. The book is based on a study of over 1,000 millionaires and found that most millionaires are ordinary people who have built their wealth through hard work, thrift, and smart financial decisions. The book argues that the key to building wealth is to live below one's means, invest in appreciating assets, and avoid unnecessary expenses and debt. The book also provides practical advice for accumulating wealth, including tips for budgeting, saving money, and investing for the long-term.

The Compound Effect: Jumpstart Your Income, Your Life, Your Success

"The Compound Effect: Jumpstart Your Income, Your Life, Your Success" is a personal finance book written by Darren Hardy that provides a step-by-step guide for achieving financial success. The book is based on the concept of compound interest and argues that small, consistent actions can have a significant impact on one's financial success over time. The book provides practical advice for making positive changes in one's financial habits, including setting goals, budgeting, and investing in one's education and career. The book also encourages readers to focus on their personal growth and to develop positive habits in order to achieve long-term success.

The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich

"The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich" is a personal finance book written by David Bach that provides a step-by-step guide for achieving financial success. The book argues that anyone can become a millionaire by following a few simple habits and provides practical advice for building wealth, including tips for setting and achieving financial goals, investing in one's education and career, and paying off debt. The book also emphasizes the importance of automating one's finances, including setting up automatic savings and investment plans, in order to achieve financial success. The book includes a range of practical exercises and tools for helping readers to take control of their finances and achieve their financial goals.

Rich Dad Poor Dad

"Rich Dad Poor Dad" is a personal finance book by Robert Kiyosaki that advocates for financial literacy and advocates for creating passive income streams through investing in assets, such as real estate and small businesses. The book is based on the lessons Kiyosaki learned from two father figures in his life: his biological father, who was a poor and financially illiterate man, and his friend's father, who was a wealthy businessman. The book encourages readers to focus on increasing their financial intelligence and to shift their mindset from traditional employment and saving money to building wealth through investing and creating passive income streams.

The Latte Factor: Why You Don't Have to Be Rich to Live Rich

"The Latte Factor: Why You Don't Have to Be Rich to Live Rich" is a personal finance book written by David Bach and John David Mann that provides a simple and straightforward approach to building wealth. The book argues that small, daily expenses, such as buying a latte or eating out, can add up over time and prevent people from achieving their financial goals. The book provides practical advice for reducing expenses and increasing income in order to build wealth, including tips for budgeting, saving money, and investing for the long-term. The book also emphasizes the importance of setting financial goals and developing a plan for achieving them. The book includes a range of practical exercises and tools for helping readers to take control of their finances and achieve their financial goals.

I Will Teach You to Be Rich

"I Will Teach You to Be Rich" is a personal finance book written by Ramit Sethi that provides a step-by-step guide for achieving financial success. The book covers a range of topics related to personal finance, including budgeting, saving, investing, and managing debt. The book also provides practical advice for building a successful career and for planning for retirement. The book emphasizes the importance of taking control of one's financial life and encourages readers to set financial goals and to develop a plan for achieving them. The book includes a range of practical exercises and tools for helping readers to take control of their finances and achieve their financial goals.

Investing

The following books are more focused on the investing side of personal finance.

The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

"The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns" is a personal finance book written by John C. Bogle, the founder of Vanguard and a pioneer of low-cost index fund investing. The book provides a straightforward approach to investing and argues that most investors would be better off using low-cost index funds rather than trying to beat the market through active investing. The book emphasizes the importance of diversification, low costs, and a long-term perspective when investing and provides practical advice for creating and managing a diversified investment portfolio. The book also covers a range of topics related to investing, including asset allocation, saving for retirement, and minimizing taxes.

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition)

"The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition)" is a personal finance book written by Benjamin Graham that is considered a classic in the field of investing. The book advocates for the principles of value investing, which involve buying undervalued stocks or other securities with the expectation that their value will increase over time. The book also emphasizes the importance of diversifying one's investment portfolio and maintaining a long-term perspective when investing. The book provides practical advice for individual investors, including how to evaluate a company's financial health and how to manage risk. The revised edition includes commentary by Warren Buffett, one of the most successful investors of all time.

The Simple Path to Wealth: Your road map to financial independence and a rich, free life

"The Simple Path to Wealth: Your road map to financial independence and a rich, free life" is a personal finance book written by JL Collins that provides a simple and straightforward approach to building wealth. The book advocates for a low-cost, passive investment strategy and emphasizes the importance of starting to invest as early as possible in order to take advantage of compound interest. The book also provides practical advice for creating a financial plan, including tips for budgeting, saving money, and investing for the long-term. The book encourages readers to focus on their financial goals and to make smart financial decisions in order to achieve financial independence.

The Bogleheads' Guide to Investing

"The Bogleheads' Guide to Investing" is a personal finance book written by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf that provides practical advice for individual investors. The book is based on the principles of investing advocated by John Bogle, the founder of Vanguard and a pioneer of low-cost index fund investing. The book emphasizes the importance of diversification, low costs, and a long-term perspective when investing and provides practical advice for creating and managing a diversified investment portfolio. The book also covers a range of topics related to investing, including asset allocation, saving for retirement, and minimizing taxes.

The Millionaire Real Estate Investor

"The Millionaire Real Estate Investor" is a personal finance book written by Gary Keller that provides a practical guide for building wealth through investing in real estate. The book covers a range of topics related to real estate investing, including how to find and evaluate investment properties, how to finance real estate investments, and how to manage rental properties. The book also provides practical advice for building a successful real estate investment business, including tips for creating a business plan, finding and working with partners, and building a team of professionals. The book encourages readers to think strategically and to take a long-term approach when investing in real estate.

The Elements of Investing: Easy Lessons for Every Investor

"The Elements of Investing: Easy Lessons for Every Investor" is a personal finance book written by Burton G. Malkiel and Charles D. Ellis that provides a simple and straightforward approach to investing. The book covers a range of topics related to investing, including asset allocation, diversification, and managing risk. The book also provides practical advice for creating and managing a diversified investment portfolio and for choosing investments that are suitable for one's financial goals and risk tolerance. The book emphasizes the importance of a long-term perspective when investing and encourages readers to focus on building wealth over the long-term rather than trying to beat the market in the short-term. The book is written in a clear and concise style and is intended for both novice and experienced investors.

The Four Pillars of Investing: Lessons for Building a Winning Portfolio

"The Four Pillars of Investing: Lessons for Building a Winning Portfolio" is a personal finance book written by William J. Bernstein that provides a comprehensive approach to investing. The book covers a range of topics related to investing, including asset allocation, diversification, and managing risk. The book also provides practical advice for creating and managing a diversified investment portfolio and for choosing investments that are suitable for one's financial goals and risk tolerance. The book emphasizes the importance of a long-term perspective when investing and encourages readers to focus on building wealth over the long-term rather than trying to beat the market in the short-term. The book is written in a clear and concise style and is intended for both novice and experienced investors.